How To Add Money To A Long Term Liability To Quickbooks

A long-term liability is an obligation by a business organization or organization to repay funds borrowed. The repayment of that obligation is spread over more than than one twelvemonth (operating wheel). Examples of long-term liabilities are mortgages, bonds payable, and vehicle loans. Long-term liability accounts have a normal credit balance. They increase on the credit side and decrease on the debit side. Long-term liabilities are often called long-term debt.

What is the Difference Between a Long-term Liability and a Electric current (Brusk-term) Liability?

A long-term liability has a repayment schedule that has payments due more than one year in the future. A current liability is paid within ane year.

For more than knowledge well-nigh Current Liabilities, watch this video:

What are some Examples of Long-term Liabilities?

Long-term liabilities include:

| Mortgage Payable | Pension Liabilities |

| Notes Payable | Deferred Tax Liabilities |

| Bonds Payable | Uppercase Leases |

| Customer Deposits (if carried into hereafter years) | Deferred Compensation |

| Deferred Revenue (if carried into future years) | Mail service-retirement Healthcare Liabilities |

Accounting for Long-term Liabilities

When a company or organization takes on a new liability, information technology needs to be entered as a liability. Some typical transactions for bookkeeping for Long-term Liabilities are listed beneath.

Adding a New Long-term Liabilities to the Books

Purchase of an Asset: a company purchases a vehicle (Fixed Asset) for $40,000, financing $thirty,000 for 5 years at an involvement rate of 5%, and paying the remaining $10,000 in cash. The journal entry to record the new nugget, new loan, and reduction in cash is:

| Vehicle | 40,000 | |

| Vehicle Loan | 30,000 | |

| Cash | 10,000 |

Issuing a Bond: a company issues a bond for $200,000 at face up value. (For more information nigh bonds, read this article: https://accountinghowto.com/bonds-payable.) The journal entry to record the new liability and the increase in cash is:

| Cash | 200,000 | |

| Bond Payable | 200,000 |

Making payments of a Long-term Liability

When a visitor or organization takes on debt, each debt has its own payment schedule and interest rate. When a payment is made, the master (a portion of the loan corporeality) is tracked separately from the involvement portion of the loan.

Equally an instance, let'south say the vehicle loan had monthly payments of $500 including $50 of involvement. The journal entry to record the payment is:

| Vehicle Loan | 450 | |

| Interest Expense | fifty | |

| Cash | 500 |

Most loans are gear up for more involvement to be paid in the early years of a loan, with decreasing interest amounts as the loan progresses. This interest payment construction is detailed in an amortization schedule.

What is an Acquittal Schedule?

An amortization schedule breaks the payments on a loan into main payments and interest payments.

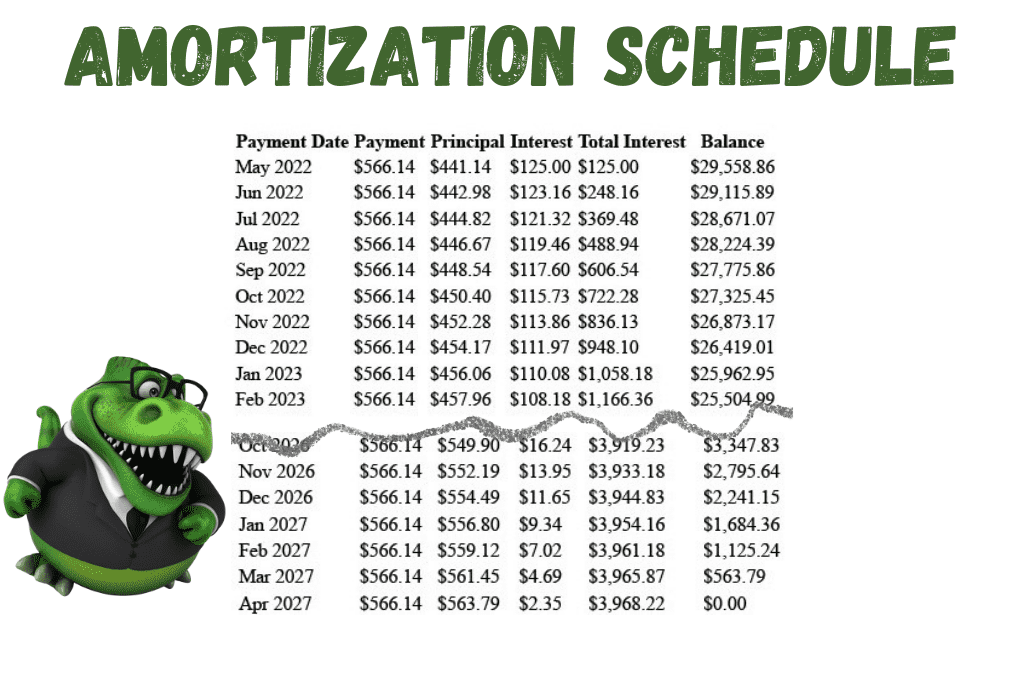

Here is a sample amortization schedule for the Vehicle loan:

The amortization schedule shows the decreasing amount of involvement as each payment is made, and the decrease in the principal balance. In the 60th calendar month of the loan (5 years 10 12 payments), the principal rest reaches zero and the loan is paid in full.

Using the amortizations schedule, principal and involvement payments can be easily tracked and recorded each time a payment on the loan is due.

For the first payment due, the journal entry to record the principal and interest is:

| Vehicle Loan | 441.fourteen | |

| Interest Expense | 125.00 | |

| Cash | 566.fourteen |

For businesses required to follow Generally Accustomed Accounting Principles (GAAP), an boosted adding is needed to split the portion of long-term debt due in the next twelve months (operating cycle.) This portion of long-term debt is classed as a current liability rather than a long-term liability.

What is Current Portion of Long-term Debt?

Current Portion of Long-term Debt is the amount of principal due on liabilities in the next twelve months. Information technology is separated out from the total amount of long-term liabilities to help a business concern understand the amount of debt payments due in the well-nigh futurity.

For example, if total long-term liabilities equals $xx,000 and of that, $5,000 is due in the next yr's fourth dimension, this debt is considered to be a Current Liability. For a deeper understanding of Current Portion of Long-term Debt, sentinel this video:

Source: https://accountinghowto.com/long-term-liability/

Posted by: waldropdecien.blogspot.com

0 Response to "How To Add Money To A Long Term Liability To Quickbooks"

Post a Comment